Loan providers normally wanted at least credit rating out-of 580 to own FHA, Va and you can USDA money and 620 getting old-fashioned funds, based on Rodriguez. Thus, you might have to improve credit rating and you can help save to own increased down-payment . You also need to remove your own produce-offs, if at all possible. Your own CPA wishes one to shell out quicker during the taxes, but because the Rodriguez points out, for individuals who statement a loss towards Irs, loan providers and banks see that since the bad money, and also you won’t qualify for a mortgage. It’s great getting income tax motives, however ideal for certification purposes.

You’re probably recording your earnings for your taxes anyhow, however if you’re self-operating and you may trying to get a mortgage, this is the time to genuinely belt off and you can get it done.

Package beforehand

You’ll not discover until you promote the ideas to help you that loan officer for many who qualify for a home loan. Rodriguez implies submission the taxation statements in order to a loan provider or financing administrator before you plan to purchase therefore we can dictate your earnings as said into Internal revenue service. If in case it is not enough to be eligible for your house you require, we could advise you on which quantity of money becomes necessary. At exactly the same time, loans in Spring Lake loan providers can work with your specific organization make-offs and advise you on precisely how to replace your funds and you will losses report.

Thankfully one lenders never discriminate against you mainly based in your income type of. Either you meet the requirements or if you never centered on your earnings. Juan Rodriguez, origination manager to possess Zillow Home loans

Envision and make a high down payment

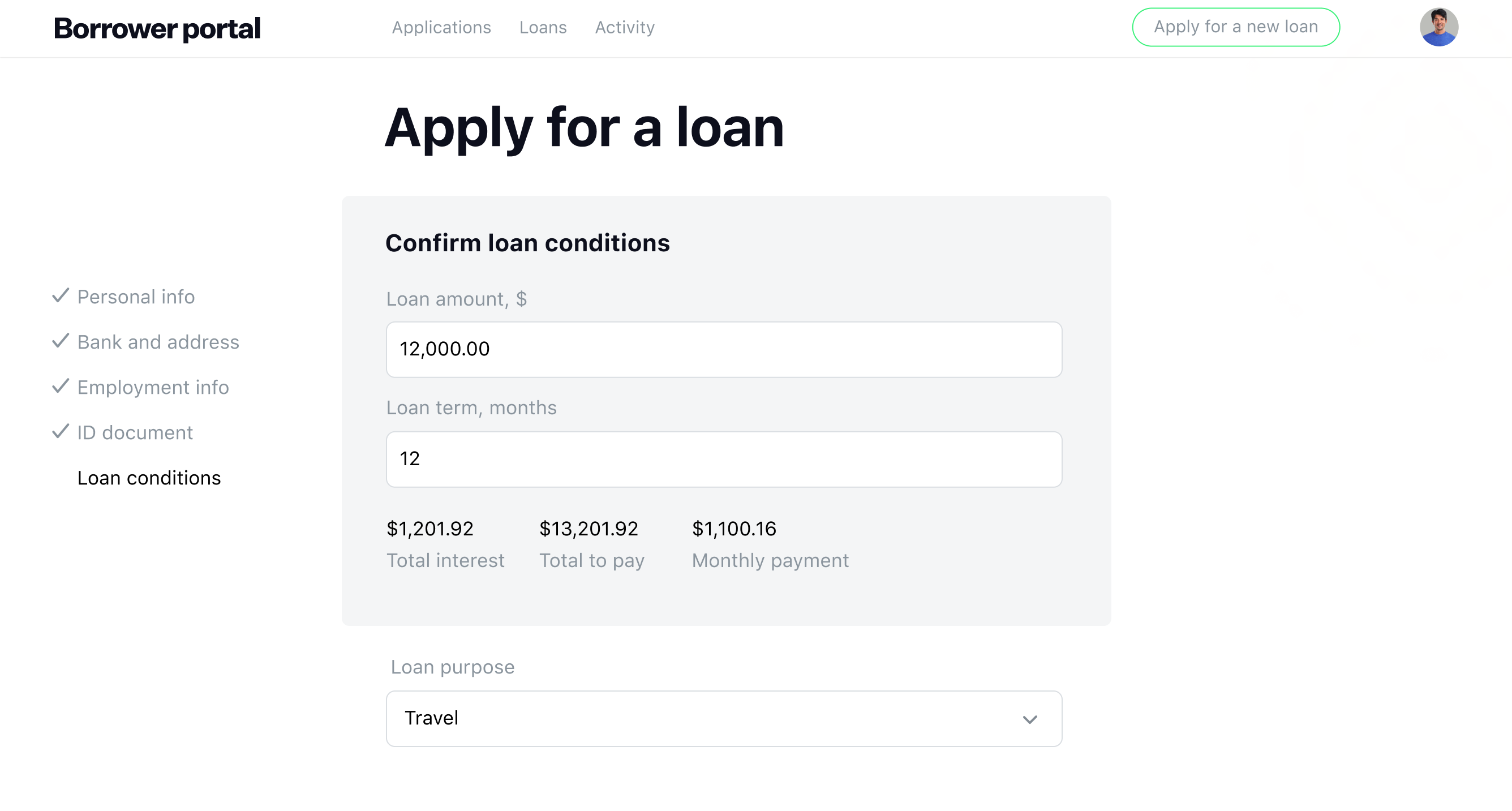

Getting extra cash off could help decrease your mortgage repayment. Already, all the $ten,one hundred thousand reduces the dominating and you may desire percentage from the up to $fifty 30 days. If you do not be eligible for home financing due to your debt-to-earnings (DTI) proportion, you may have to have more currency right down to take your percentages prior to taking accepted.

Comparison shop

Evaluate rates and you will charge out of at least about three lenders, incase it’s your very first time, work on an individual who focuses on very first-time homeowners (anyone who has perhaps not owned property during the last three years) and certainly will answer all your valuable inquiries. Brand new Zillow Group Opportunities site enables you to evaluate their costs together with other loan providers.

Let’s say Really don’t qualify for a home loan since a freelancer?

If you feel such you really have all your valuable ducks for the a good line and you however do not be eligible for a traditional financial, discover what exactly is labeled as non-qualified mortgages (otherwise non-QM funds). This type of come from loan providers that may agree you on your disgusting receipts and you will lender statements and do not fundamentally you would like your taxation statements. But by the risk, the mortgage may come with a higher level – possibly 2% to three% higher than the supposed old-fashioned speed, states Rodriguez.

One of these from a non-QM loan is a balloon home loan. A beneficial balloon mortgage begins with the lowest price into very first long-time, and therefore the dominant balance has to be paid in complete. (If you fail to pay the balloon commission at the conclusion of the mortgage, you could potentially refinance or you could sell your house. But it is an excellent riskier version of financing since you take new chance you to definitely home values you may reduced total of committed anywhere between getting from the financing and you can needing to offer.)

If you are care about-employed and looking getting solution a method to safe a mortgage, you might also imagine to get property which have a partner . Find anyone who has an excellent W2 and you will regular income. If a friend or relative, you need to have an advanced level out-of believe with each almost every other, and you have so you’re able to set the floor regulations for common control. Handling a beneficial agent and you may legal counsel is also help to keep group for a passing fancy webpage.

Laisser un commentaire